China-based AI and big data company pivots to additive manufacturing with three-layer vertical integration model combining hardware scale, design automation, and production management

Chinese publicly-listed company Winner Technology (汇纳科技, 300609.SZ) has acquired Shenzhen Jinshi Huasu Technology (金石华速) and announced a strategic partnership with 3D printer manufacturer Bambu Lab (拓竹科技), Securities Times reported December 15. The companies plan to deploy 15,000 Bambu Lab printers by the first quarter of 2026, with approximately 5,000 units currently being deployed in Shenzhen.

The Move

Winner Technology (汇纳科技), a Shanghai-based AI and big data solutions provider, completed the acquisition of Shenzhen Jinshi Huasu Technology (金石华速) in December 2025, bringing a 1,000-plus printer farm under its control. The acquisition coincides with the company’s partnership with Bambu Lab (拓竹科技) to deploy 15,000 3D printers by the first quarter of 2026, with 5,000 units currently being deployed.

The integrated operation targets the designer toy and IP-licensed merchandise sector, leveraging Winner Technology’s background in AI and data analytics to address personalization demands in consumer manufacturing. Li Jian, founder of Jinshi Huasu, stated that the company aims to optimize the entire industrial chain and build an IP+AI integrated production model.

Background

Winner Technology, established in 2004 and listed on Shenzhen’s ChiNext board in 2017 under stock code 300609.SZ, originally focused on retail analytics and smart city solutions.

Jinshi Huasu operates a printing farm exceeding 1,000 units. The facility handles on-demand production for designer toys, IP-licensed merchandise, and custom merchandise, establishing operational expertise in managing large-scale distributed manufacturing networks.

The partnership with Bambu Lab centers on deploying the company’s consumer-grade FDM equipment, known for speed, reliability, and cost-effectiveness. The report states that Bambu Lab equipment runs in over 70% of global 3D printing farms. The planned deployment of 15,000 printers by Q1 2026 would create what the companies describe as the world’s largest 3D printing factory, with 5,000 units currently being deployed in Shenzhen.

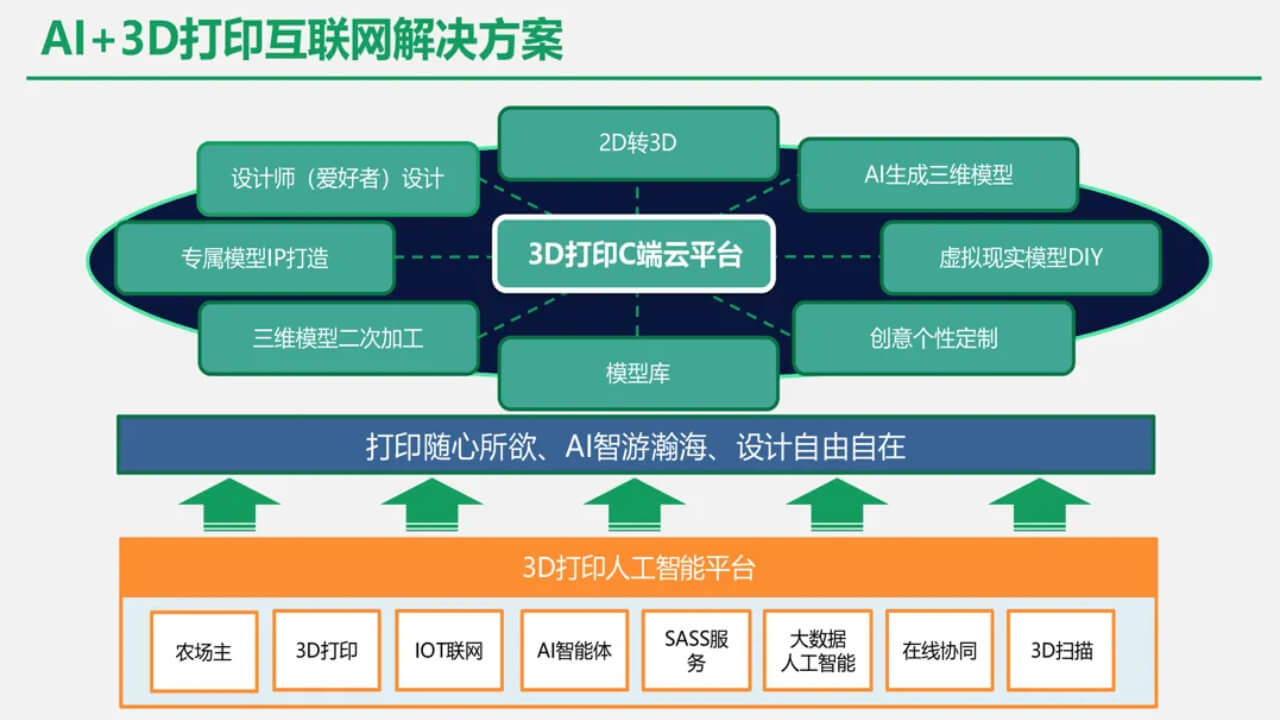

Supporting this hardware infrastructure, Winner Technology’s wholly-owned subsidiary Jinshi Zhihui (金石智汇) developed a SaaS platform for centralized management across distributed printing operations. The platform integrates AI-powered design tools that generate 3D models from text or image inputs, a marketplace connecting independent designers with production resources, and farm management software that optimizes print paths and adjusts process parameters for complex geometries.

The platform architecture reflects Winner Technology’s core competencies in AI algorithms and big data, areas where the company built its business serving retail analytics clients before the manufacturing pivot. Winner Technology characterized the platform’s AI capabilities as enabling faster creative output to market rather than replacing human design work.

What Emerges

The acquisition and deployment reveal a three-layer vertical integration model combining AI-driven design assistance, centralized production management, and mass hardware deployment. This structure diverges from traditional 3D printing service bureaus operating standalone facilities with limited automation.

At the AI layer, Winner Technology applies algorithmic capabilities developed for retail analytics to generative design tools and process optimization. The approach treats design as an assistive function—accelerating iteration and reducing technical barriers—rather than autonomous creation. For designer toy production, where personalization and rapid iteration define market dynamics, reducing the time from concept to physical prototype directly addresses customer expectations.

The SaaS management layer represents a departure from conventional farm operations, which typically manage equipment through vendor-specific software with limited cross-machine coordination. Centralized control across 15,000 units enables load balancing, predictive maintenance scheduling, and standardized quality protocols—operational advantages that scale with fleet size. The farm management system reportedly adapts printing parameters based on geometry complexity and material properties, though the Securities Times report does not specify the extent of automation versus operator oversight.

Hardware scale provides the foundation for this model. Deploying 15,000 consumer-grade printers rather than industrial systems reflects a bet on distributed capacity over individual machine capability. Consumer equipment typically offers lower capital costs and simpler maintenance compared to industrial alternatives, though with trade-offs in material compatibility and build volume. For designer toys and IP-licensed merchandise—applications with relatively modest size and material requirements—this trade-off appears calculated to prioritize throughput and flexibility over technical range.

The industrial logic parallels developments in other manufacturing sectors where software companies acquire production assets to vertically integrate supply chains. Digital-native companies entering physical manufacturing often emphasize data collection and process control as competitive advantages, using information systems to optimize operations that traditional manufacturers manage through accumulated experience. Whether this approach yields sustainable advantages depends on execution and market response, areas where Winner Technology’s track record in manufacturing remains limited.

The global 3D printing market reached $24.6 billion in 2024, with projected compound annual growth of nearly 20% over the next decade, according to Precedence Research data cited by Securities Times. China’s additive manufacturing equipment production grew 40.5% year-over-year through the first three quarters of 2025. These figures suggest expanding demand, though they do not guarantee profitability in specific segments like designer toys, where consumer preferences and pricing sensitivity remain variables.

Looking Ahead

Winner Technology’s model tests whether the combination of AI-driven design assistance, centralized management, and hardware scale can address the modern manufacturing challenge of rapid product development and faster time-to-market through tooling-free production. The company positions designer toys and IP-licensed merchandise as initial applications, though the platform architecture could theoretically extend to other small-part manufacturing scenarios.

Success depends on execution across multiple dimensions: whether AI design tools actually accelerate creative workflows, whether SaaS management delivers measurable efficiency gains across 15,000 printers, and whether the consumer market for 3D printed designer toys develops as anticipated. Winner Technology brings AI and data expertise but limited manufacturing experience. Bambu Lab provides hardware and consumer market knowledge. Jinshi Huasu contributes operational experience managing large printer farms.

The outcome will indicate whether software-centric companies can effectively compete in physical manufacturing by treating production as a data optimization problem, or whether the complexities of running tens of thousands of printers ultimately favor traditional manufacturing expertise. Either way, the integration of AI, mass hardware deployment, and centralized management represents a testable hypothesis about the future organization of distributed manufacturing for personalized consumer products.