TCT Japan 2026 took place January 28-30 at Tokyo Big Sight. As a preliminary report before official attendee and exhibitor statistics are released by the organizers, AM Insight Asia (AMIA) spotlights notable exhibitors across two articles. From approximately 130 exhibiting companies at TCT Japan, AMIA selected 20 companies based on our unique perspective. Part 1 introduces the first 10 companies. The order of coverage is random and carries no special significance. This selection reflects AMIA’s subjective editorial judgment and does not imply that unlisted exhibitors are not noteworthy.

1. NTT DATA XAM Technologies

Company Overview:

NTT DATA XAM Technologies has served as EOS’s exclusive distributor in Japan since 1993. The company operates one of Japan’s largest-class metal AM service bureaus, maintaining approximately 20 EOS metal 3D printers and over 30,000 inspection data records. Beyond equipment sales, they have established themselves as a comprehensive AM solution provider handling technical support, application development, and mass production support.

Why AMIA Noticed:

We spoke with them about the EOS M4 ONYX, the latest metal printer announced at Formnext in November 2025. The most significant innovation is the integration of RFS Pro (next-generation Recirculation Filter System). This system separates powder particles and spatter generated during the build process, reducing hazardous waste by up to 90% while enabling powder reuse rates exceeding 90%. Traditional filter consumables become unnecessary, and waste disposal is simplified.

What AMIA found particularly noteworthy was EOS’s product development approach. According to their representatives, many features integrated into the M4 ONYX were originally developed and provided individually as custom solutions for existing machine models. Functions that had been added as updates to existing machines in response to customer needs have now been integrated and incorporated into the M4 ONYX from the outset.

This goes beyond mere specifications of what’s technically possible or not. We were once again impressed by their commitment to developing equipment that truly works in manufacturing environments by solving problems that emerge when integrated into production processes—waste management for workers, job automation for labor reduction, and quality assurance efficiency.

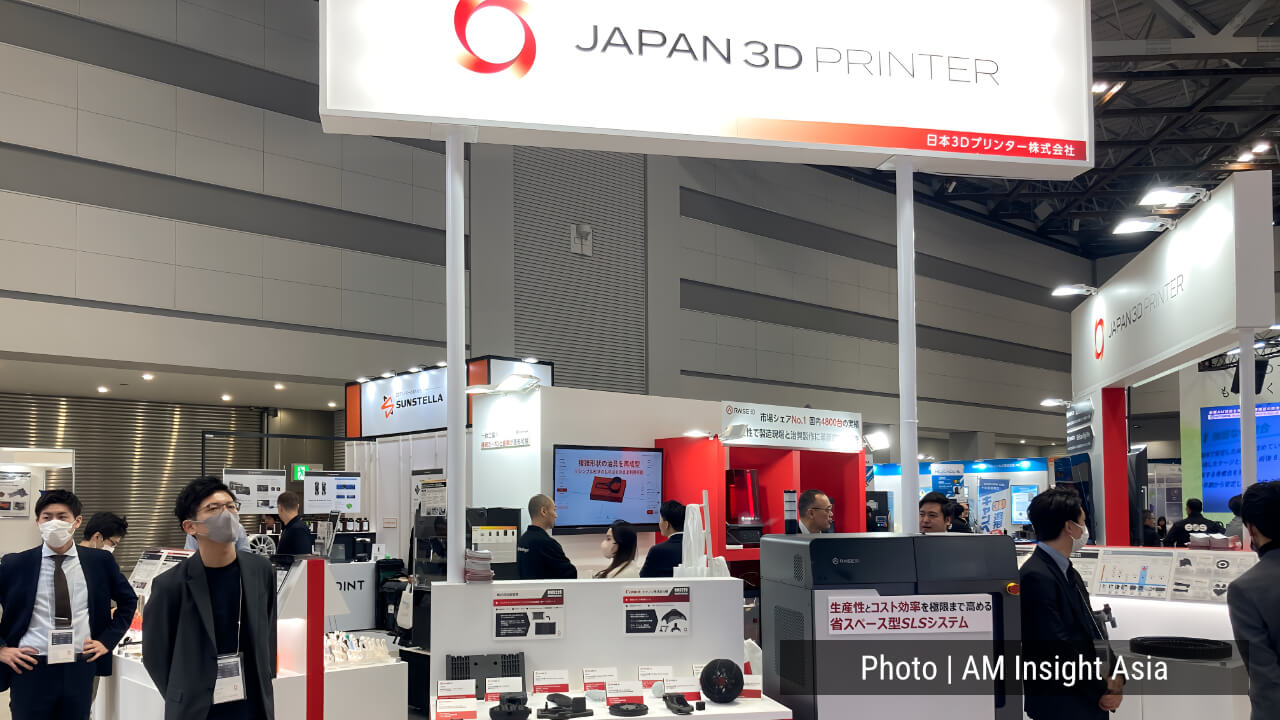

2. Japan 3D Printer

Company Overview:

Japan 3D Printer is one of Japan’s top-level distributors selling 3D printers from Raise3D, Farsoon, Markforged, and others. They also handle Shining3D scanners, actively focusing on scanner business.

Why AMIA Noticed:

While booths displayed equipment and build samples from various manufacturers, AMIA’s attention was drawn to the reference exhibit of automatic jig placement design software. This software automatically designs stable base platforms for complex-shaped prototypes and products, currently under independent development and exhibited as a reference product.

The new initiative of moving beyond mere hardware distribution toward independent software development that solves customers’ practical operational challenges left a strong impression.

3. APPLETREE

Company Overview:

Apple Tree sells 3D printers including Bambu Lab, Flashforge, and Markforged, plus Scanorogy scanners. They are unique among Japanese distributors in operating physical retail stores selling 3D-printed shoes (STARAY brand). Recently, they partnered with Nagoya Institute of Technology to establish Japan’s first large-scale 3D printing farm centered on approximately 120 Bambu Lab printers.

Why AMIA Noticed:

AMIA’s attention focused on the Flashforge CJ270, the latest model making its Japanese debut. Despite being priced under 500,000 yen, it employs a full-color inkjet system delivering 10 million colors. With its stylish design and appearance that doesn’t look like a typical 3D printer, it’s suitable for home placement.

Japan’s hobby market for figurines and similar products is actually quite large, and high expectations are placed on this machine for accessible full-color molding. We anticipate it will see significant activity in hobby markets and prototype development.

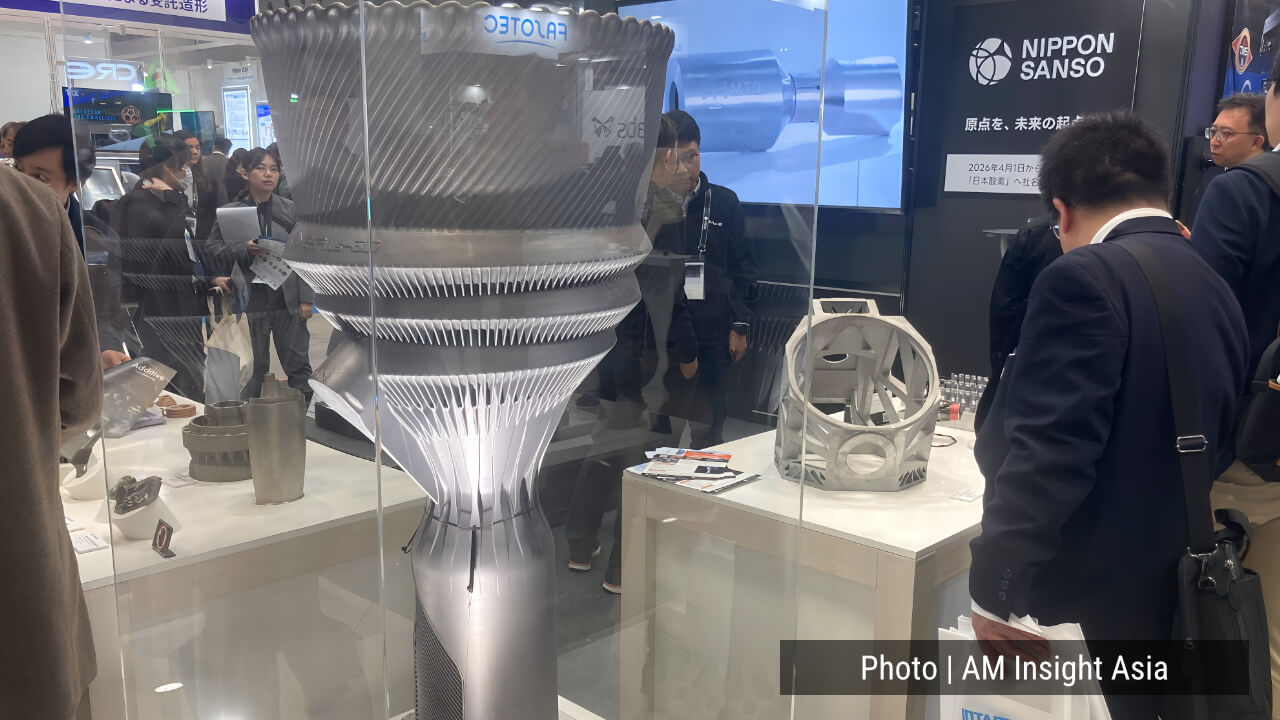

4. Taiyo Nippon Sanso

Company Overview:

Taiyo Nippon Sanso is an industrial gas company that has expanded into the 3D printer business due to natural synergies with gases used in metal 3D printing. While they previously handled ultra-high-end Vero3D specialized for space applications, they have now begun handling Eplus3D, the world’s second-largest metal AM manufacturer targeting the manufacturing industry.

Why AMIA Noticed:

AMIA’s attention focused on Taiyo Nippon Sanso’s commencement of Eplus3D handling. Eplus3D is a metal 3D printer manufacturer exported to over 40 countries worldwide, earning high praise in aerospace, automotive, and manufacturing industries for being high quality while offering excellent cost performance. By adding Eplus3D, which targets broader manufacturing industries, to their lineup alongside ultra-high-end Vero, they appear to be expanding their target market. Beyond 3D printers alone, they have been enhancing peripheral software offerings, giving the impression of strengthening solution proposals. This marks Eplus3D’s full-scale entry into the Japanese market. We anticipate seeing their active presence in 2026.

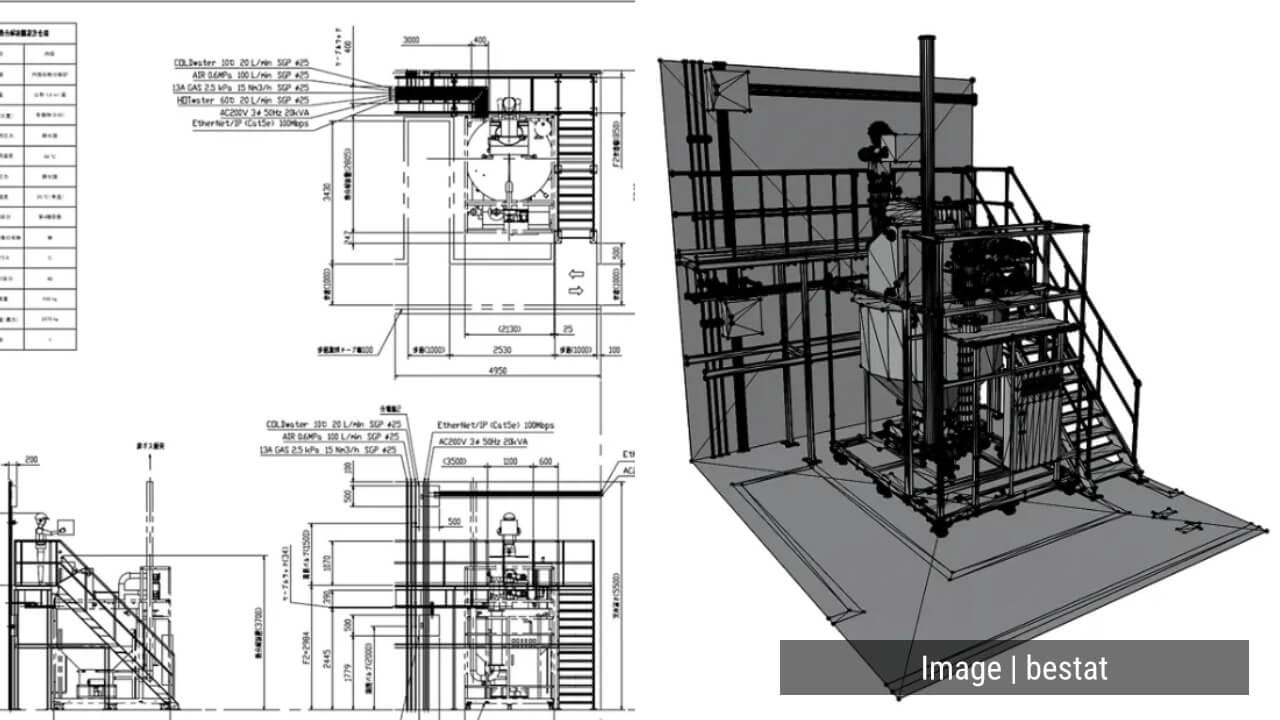

5. bestat

Company Overview:

bestat Corporation provides AI-powered services for creating 3D drawings from 2D drawings.

Why AMIA Noticed:

AMIA’s attention was drawn to this service because it directly addresses challenges facing Japanese manufacturing. In Japan, there is a shortage of personnel capable of 3D modeling, with many companies possessing 2D drawings yet unable to convert them to 3D. bestat’s service employs a hybrid approach where AI automatically creates 3D drawings from 2D drawings to some extent, with final finishing by human hands. This is because actual 2D drawings aren’t perfect, making AI alone insufficient. For companies considering 3D printer adoption, conversion from 2D drawings to 3D data often represents the first barrier. It’s not uncommon for business negotiations to fall through at the design stage despite high evaluation of 3D printers. Services like bestat will play an important role in lowering this barrier.

6. Techno Solutions

Company Overview:

Techno Solutions is known as a SOLIDWORKS distributor and also handles 3D printers. They sell the domestic manufacturer Gutenberg’s G-ZERO, Korean Carima’s DLP-type 3D printers, Markforged, and others.

Why AMIA Noticed:

AMIA’s attention was drawn to their approach of not merely displaying equipment but inviting Korean company Harvetance to exhibit actual use cases. Harvetance develops robot hand grippers and other products, and exhibited grippers developed using Gutenberg’s G-ZERO with engineering plastic “POTICON” jointly developed by Gutenberg and Otsuka Chemical.

Gutenberg’s G-ZERO achieves ultra-high-speed molding of up to 500-700mm/s while building parts with strength equivalent to injection-molded products, making it a hot topic in Japan as a domestic manufacturer. The partnership with material manufacturer Otsuka Chemical has further sharpened their competitive edge. By demonstrating actual manufacturing site use cases beyond just equipment performance, this exhibition concretely conveyed the practical utility of 3D printers.

7. SWANY

Company Overview:

SWANY is a product design company based in Ina City, Nagano Prefecture, handling everything from design to mass production using 3D data. They also possess 3D Systems’ large-format 3D printer “Titan Pellet” and can handle large-scale builds. They also sell manufacturing equipment including 3D printers.

Why AMIA Noticed:

AMIA’s attention focused on the AI mobility concept model completed in just two weeks from design initiation. This isn’t just surface-level modeling but features solid structural design. It incorporates airless tires, front-mounted recognition cameras, and color-changing LED accents.

Production combined the large-format 3D printer “Titan Pellet” with machining, appropriately utilizing each process. The speed of achieving this quality level in just two weeks and the approach of enhancing completeness by combining various technologies were impressive. This contrasts sharply with companies trying to accomplish everything with 3D printing alone. SWANY’s strength lies in their ability to materialize ideas using optimal methods in the shortest time.

8. Nagaoka University of Technology

Company Overview:

Nagaoka University of Technology boasts undoubtedly top-class manufacturing facility richness among Japanese universities. They have assembled a wide range including 5-axis machining centers, WAAM-type DED (Directed Energy Deposition), various metal 3D printers (SLM, multi-beam DED, etc.), and resin 3D printers. Furthermore, they are characterized by comprehensive evaluation and inspection equipment essential before and after manufacturing, including X-ray inspection systems.

Why AMIA Noticed:

At TCT Japan 2026, they exhibited resin molding samples, explained the DXR Manufacturing Platform Center completed in 2025, and presented research achievements.

AMIA’s attention focused on the comprehensive equipment richness extending from 3D printers through machining to inspection systems. It is extremely rare for universities to possess this many cutting-edge machines. An environment where students can learn complete manufacturing processes is extremely important from industry-academia collaboration and human resource development perspectives, holding great significance for cultivating talent who will carry Japan’s manufacturing future.

9. SOLIZE

Company Overview:

A Japanese digital engineering company engaged in 3D printing since 1990, operating as Japan’s first 3D printing service bureau. With over 35 years of experience, they maintain a largest-class domestic fleet of 42 high-end 3D printers (resin and metal). As authorized distributors for 3D Systems and HP, they have sold over 210 units to more than 130 companies, providing comprehensive support from prototyping to final part production.

Why AMIA Noticed:

HP Jet Fusion-manufactured 3D printed products were adopted for the 2024 LEXUS LC500 genuine optional parts (AT oil cooler duct). This marks Japan’s first case of an automotive manufacturer’s genuine optional parts adopting 3D printed products. SOLIZE became registered as Toyota Motor Corporation’s certified supplier. To meet automotive manufacturers’ stringent quality standards, they repeatedly conducted machine control, build condition optimization, and material verification to achieve continuous and stable material properties. In-house material development capability is also available. They constructed environmental preparation, process management, and personnel training systems for mass production factory certification. They maximized cost benefits through design and build layout optimization. They possess overwhelming track record and technical capabilities in applying 3D printing to automotive final products. At the TCT Japan exhibition, they presented well-organized exhibits by theme, showing real practical examples from prototyping to mass production, and concretely demonstrating approaches to solving actual challenges facing manufacturing industries.

10. Conflux Technology

Company Overview:

An Australian metal AM heat exchanger specialist founded in 2015. Founder Michael Fuller spent over 15 years as a senior engineer in European F1 motorsport, designing championship-winning Formula One, World Rally, and Le Mans prototype race cars. With patented Conflux Core™ technology, they handle various heat exchanger types (gas-liquid, liquid-liquid, gas-gas, cold plates) with proven track records across space, next-generation aviation, automotive, motorsport, defense, and industrial sectors. They collaborate with Pagani, Honeywell Aerospace, Xtrac, AMSL Aero, and others.

Why AMIA Noticed:

A global leader in AM heat exchangers with ultra-high-spec heat exchanger development capabilities. Exhibition content consists of various heat exchanger samples that remain consistent each time, but speaking with them reveals profound depth. Heat exchangers range from simple designs to extremely high-specification ones. Conflux excels in ultra-high-spec domains with development capabilities. Complex internal geometry designs enable highly efficient heat exchange impossible with conventional manufacturing methods. They achieve both pressure drop reduction and heat transfer performance improvement. They handle lightweight, compact, and conformal designs. Their technical capabilities address the most demanding thermal management challenges from motorsport to space rockets. While exhibition samples remain consistent, understanding the technical background and breadth and depth of application ranges makes them an unmissable exhibitor.

Part 1 Summary

Part 1 introduced 10 companies demonstrating diverse 3D printing deployments in the Japanese market. From major service bureaus to design support firms, material manufacturers, equipment distributors, and global enterprises, each contributes to Japan’s AM market through different approaches. Part 2 will introduce the remaining 10 companies, painting a more detailed picture of TCT Japan 2026. Following official statistics release from organizers, AMIA plans comprehensive articles analyzing attendee numbers, exhibitor trends, and market developments.